News

Auriel Wright (left) and Kristen Fang launched startup StrattyX to enable active investors to create, test, and automate investing strategies based on Tweets, news headlines, price changes, and more. (Photo courtesy of StrattyX)

On a Thursday in August, President Donald Trump announced on Twitter that he planned to impose a 10-percent tariff on more than $300 billion worth of imports from China. By the end of the day, the S&P 500 had fallen 0.9 percent, and the index plunged more than 3 percent the following Monday.

For investors, there is money to be made in those mercurial market swings. But effectively buying and selling based on 24/7 news reports and social media posts practically requires an algorithmic trading strategy -- and computer science skills that most investors lack.

Enter StrattyX, a startup launched by two students at the Harvard John A. Paulson School of Engineering and Applied Sciences that seeks to make algorithmic trading available to everyone. The StrattyX app enables active investors to create, test, and automate investing strategies based on Tweets, news headlines, price changes, and more.

“The market is actually more volatile now than it has ever been. There are a lot of profits to be made from trading on price changes, whether that is over the course of a year, a month, or even a day,” said Kristen Fang, A.B. ’19, a computational neuroscience concentrator and StrattyX COO. “A lot of people are now going into the market, but they don’t have the expertise to be active traders, so they end up losing a lot of money. We want to let people take on the market with their own hands.”

A user with no computer science training can use the StrattyX app to create strategies using a series of drag-and-drop options.

For instance, a user can create a strategy to buy two shares of Apple stock if CEO Tim Cook sends a Tweet that mentions increased sales, but sell two shares of Apple stock if media headlines mention a problem with the new iPhone, Fang explained.

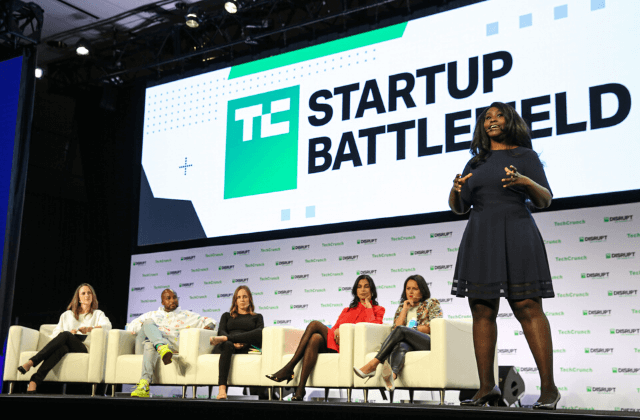

Wright pitches StrattyX at Tech Crunch Disrupt, where the startup placed in the top four. (Photo courtesy of StrattyX)

Investors can test these strategies with virtual money, evaluating their performance in real-time while also seeing how that strategy would have performed over the past year.

“That enables people to take their many different strategies and figure out which ones are good and will make solid returns, and then they can tap one button to automate that strategy,” Fang said. “Then our software will watch Tweets, news, anything on the internet for them as they go about their day, working in the background to act on their trading strategies.”

For Fang and cofounder/CEO Auriel Wright, who have been best friends since they met freshman year, their experiences playing the stock market inspired the startup.

Shortly after Wright, A.B. ’20, a computer science concentrator, began trading on Robinhood (an online, commission-free investing platform), she launched a separate, algorithm-driven portfolio on Quantopian. Wright quickly found that the bot-based portfolio outperformed her manually traded one.

That experience sparked the idea for StrattyX last September, and she and Fang have been working ever since to bring it to reality.

“The biggest challenges we’ve faced have been taking in feedback from users and other parties who are interested, but still grounding that feedback and those thought processes with the vision of the company,” Wright said. “We need feedback, but we also need to make sure that is aligned with what we’re thinking.”

The co-founders have relied on the support of the entrepreneurial community in Startup R&D (ES 95r), taught by Paul Bottino, Executive Director of Innovation Education, which they initially took last semester when StrattyX was in a nascent stage. This semester, they’ve been able to mentor some earlier stage startups, while also soliciting feedback from their fellow founders.

They have both been surprised by how quickly the startup has grown. A demo version of StrattyX is currently available in the Android and Apple store. So far, the average “fake money” return is 27 percent, Fang said.

They will soon roll out the full version of the app, which will enable users to trade with real money by connecting their brokerages to StrattyX. Down the road, they’d like to enhance the app to give users more strategy options.

For instance, they are considering expanding the algorithms to track press releases. The prices of biotech stocks tend to fluctuate based on the success of clinical trials, Fang explained, and that information is often first published in a press release.

For Wright, the success of StrattyX is the best testament to the validity of her initial idea, even as the co-founders overcome the bumps of entrepreneurship. They recently won $25,000 in the PitcHER Competition at the 2019 Grace Hopper Celebration and placed in the top four at Tech Crunch Disrupt.

Being able to build something useful, while drawing on her skills and passions, makes the struggles well worth the effort, Wright said.

“I’ve learned that everyone’s startup is different, as well as everyone’s failure,” she said. “Don’t let other people’s failures scare you. Consider it as a data point, analyze it if you can, skirt around it, and work with it. Don’t let it hinder or stop you.”

Topics: AI / Machine Learning, Computer Science, Entrepreneurship

Cutting-edge science delivered direct to your inbox.

Join the Harvard SEAS mailing list.

Press Contact

Adam Zewe | 617-496-5878 | azewe@seas.harvard.edu